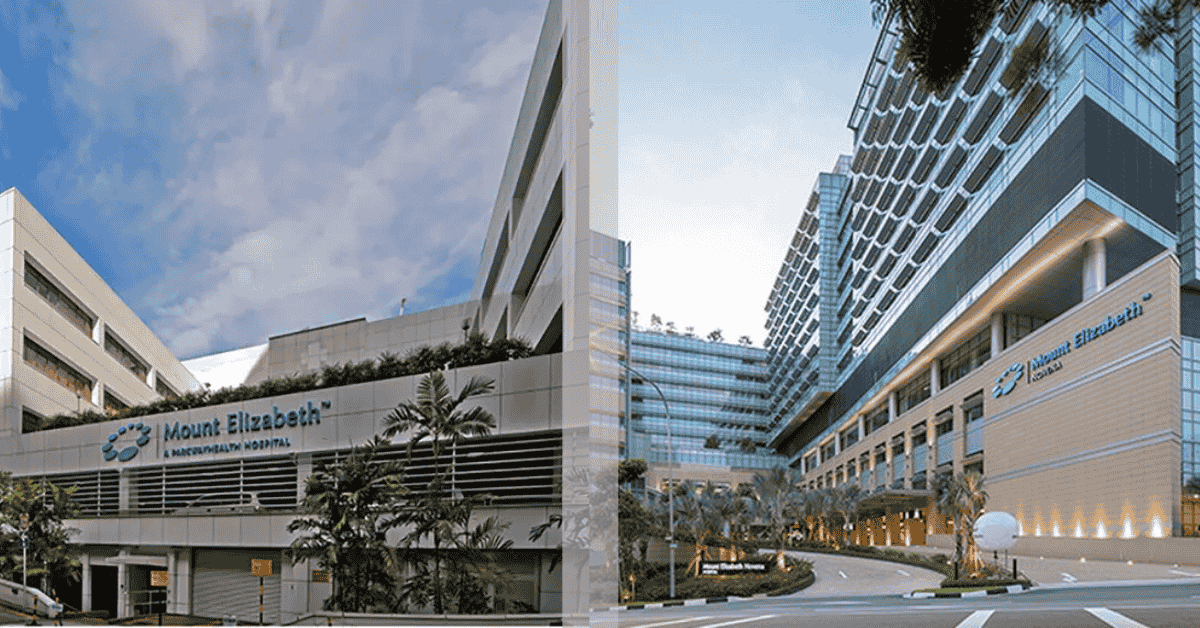

On June 17, 2025, Great Eastern, a leading insurance provider in Singapore, announced it would temporarily stop issuing pre-authorisation certificates for medical admissions at Mount Elizabeth Hospital and Mount Elizabeth Novena Hospital. This move has raised concerns among policyholders, especially those planning treatment at these hospitals. The pause in Great Eastern pre-authorisation at Mount Elizabeth is part of the insurer’s broader effort to manage rising healthcare costs and ensure long-term affordability.

In this article, we’ll explain what pre-authorisation means, why Great Eastern made this decision, how it may affect you as a policyholder, and what steps you can take to navigate the changes with confidence.

What Is Pre‑Authorisation?

Pre‑authorisation is an advance approval issued by an insurer confirming that a patient’s proposed medical treatment is covered under their insurance plan. This process typically outlines:

- The treatment or procedure to be covered

- The estimated costs

- Associated expenses like medication, room charges, and doctor’s fees

The main purpose of pre‑authorisation is to ensure cost transparency and peace of mind for patients before undergoing treatment. It also allows patients to benefit from cashless hospital admissions, avoiding the burden of upfront payments.

Why Did Great Eastern Pause Pre‑Authorisation at Mount Elizabeth?

According to official communications from Great Eastern to its panel doctors, the decision was driven by significantly higher treatment costs at Mount Elizabeth Hospital and Mount Elizabeth Novena, as compared to other private hospitals.

The insurer clarified that this move is not a reflection of the hospitals’ clinical quality, but rather a cost-management strategy to prioritise facilities offering high-quality care with better price transparency and efficiency.

“We are temporarily pausing these certificates to address the issue of rising charges from the two hospitals,” a Great Eastern spokesperson stated.

Statement from Mount Elizabeth Hospitals

In response, IHH Healthcare, which operates Mount Elizabeth hospitals, expressed surprise at the decision. Mr. Yong Yih Ming, Chief Operating Officer of IHH Healthcare Singapore and CEO of Mount Elizabeth Hospital, emphasized that:

- Discussions with Great Eastern were ongoing when the pause was announced

- The two hospitals manage complex medical cases with specialized facilities not found elsewhere

- Despite the insurer’s decision, cashless access for patients will remain available

- The hospital is working with doctors to provide transparent pricing packages

What Does This Mean for Policyholders?

Policyholders covered by Great Eastern can still receive care at both Mount Elizabeth hospitals. However, due to the paused pre‑authorisation:

- They may need to pay upfront and submit claims afterward

- There may be delays in claim reimbursements

- No change has been made to existing benefits or coverage terms

This has caused concern among policyholders, many of whom pay high premiums and expect guaranteed access to cashless hospitalisation.

How Rising Costs Are Shaping Insurance Decisions

This move reflects a broader trend across Singapore’s healthcare landscape. As the population ages, healthcare spending is rising, prompting insurers to evaluate the sustainability of their policies.

In January 2025, Great Eastern also revised its Integrated Shield Plans (IPs), reducing the coverage for private hospital visits under certain plans from 70% to 35%.

These adjustments are part of ongoing efforts to:

- Manage escalating healthcare costs

- Ensure insurance plans remain affordable

- Promote cost-conscious behaviour among patients and providers

What Should Affected Patients Do?

If you’re a Great Eastern policyholder planning or undergoing treatment at Mount Elizabeth, consider the following steps:

- Consult your financial consultant or insurer to clarify your plan’s terms and claims procedures

- Speak to your healthcare provider about treatment costs and available packages

- Retain all medical documents and receipts for claims submission

- Consider alternative hospitals on the Great Eastern panel that still offer pre‑authorisation

Speak to a Financial Consultant to Understand Your Coverage

The temporary suspension of pre‑authorisation by Great Eastern at Mount Elizabeth hospitals highlights the ongoing challenge of balancing healthcare quality with affordability. While coverage remains intact, the change may affect how and when policyholders receive their reimbursements.

As Singapore’s healthcare system continues to evolve, it’s important for policyholders to stay informed and take an active role in managing their insurance coverage. This change underscores the need to understand how adjustments may affect claims, reimbursements, and provider access. If you have questions about panel doctors, coverage gaps, or claim procedures, connect with our preferred financial consultant today. We’re here to help you navigate these changes with confidence and clarity.

Disclaimer: 365Asia aims to provide accurate and up-to-date information, our contents do not constitute medical or any professional advice. If medical advice is required, please consult a licensed healthcare professional. Patient stories are for general reading. They are based on third-party information and have not been independently verified.