Breast cancer is the most common cancer among women in Singapore, accounting for nearly 1 in 3 female cancer diagnoses, according to the Singapore Cancer Registry. As more women undergo regular screening and early detection improves, many are now seeking clarity on breast cancer treatment costs and insurance coverage in Singapore. While early treatment significantly improves outcomes, the financial demands can be overwhelming.

This guide walks you through screening options, treatment pathways, typical cost estimates, and explains how insurance such as MediShield Life, MediSave, Integrated Shield Plans, and Critical Illness coverage can help reduce the financial burden.

Browse Cancer Marker Screening Packages

What Is Breast Cancer?

Breast cancer begins when abnormal cells in breast tissue multiply uncontrollably, forming a malignant tumour. In Singapore, it is the most common cancer among women, and early detection significantly improves survival rates. Signs may include:

- A lump in the breast or armpit

- Changes in breast shape or skin texture

- Nipple discharge or inversion

- Dimpling or skin retraction

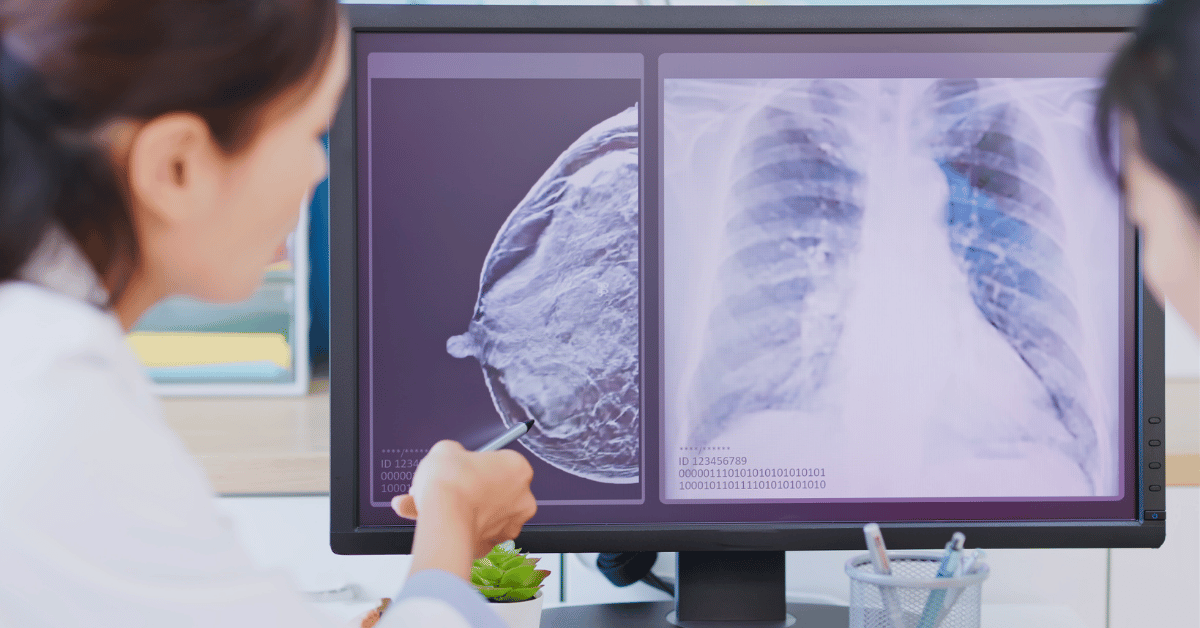

Diagnosis usually involves screening tests like a mammogram, followed by ultrasound and a core needle biopsy to determine the cancer’s type, such as HER2-positive or hormone receptor-positive. Identifying the type of breast cancer helps guide the most appropriate treatment plan.

Screening and Diagnosis: Cost Estimates

Early screening increases the chances of successful treatment and may reduce long-term breast cancer treatment costs. Below are typical out-of-pocket costs in Singapore:

- Mammogram at public clinics (with subsidy): SGD 50 – 100

- Private clinic mammogram: SGD 150 – 200

- Ultrasound-guided core needle biopsy: SGD 600 – 1,000

Women aged 50 and above can claim up to SGD 400 per year from MediSave for mammogram screenings.

These procedures help in detecting breast cancer early and identifying the specific cancer subtype for personalised treatment planning.

Breast Cancer Treatment Pathways & Costs

Once diagnosed, breast cancer treatment in Singapore often includes a combination of surgery, chemotherapy, radiation, and targeted therapy. Here’s a breakdown of the typical treatment costs:

1. Surgery

- Public hospital (Ward C): SGD 1,150 – 1,257

- Private hospital or specialist clinic: SGD 4,000 – 9,800

Procedures may include lumpectomy or mastectomy, depending on the cancer stage and location.

2. Chemotherapy

- Public hospital (Ward C): SGD 485 – 565 per cycle

- Subsidised Ward B2: ~SGD 1,246 per cycle

- Private hospitals: SGD 3,338 per cycle

Most patients require between 4 to 8 cycles.

3. Radiation Therapy

- Full course: SGD 25,000 – 30,000

Radiation is often used after surgery to kill remaining cancer cells.

4. Targeted Therapy or Immunotherapy

- Trastuzumab (Herceptin): Annual cost ranges from SGD 25,865 to 65,000, depending on whether it’s delivered via IV or subcutaneous injection.

Subcutaneous injections can reduce costs by up to 60%.

5. Diagnostic Imaging

- PET/CT scans: SGD 2,000 – 3,500

Used to assess the spread or recurrence of cancer.

Insurance Coverage for Breast Cancer Treatment

Insurance helps reduce out-of-pocket breast cancer treatment costs, especially when treatments extend over several months or years.

MediShield Life

- Covers inpatient and day surgery, including mastectomy or lumpectomy

- Pays for approved Cancer Drug List (CDL) medications, such as Herceptin

- SGD 200–9,600 per month for drugs

- SGD 3,600 per year for consultations, scans, and supportive care

MediSave

- Up to SGD 400/year for mammogram screenings

- Monthly withdrawal of SGD 600 for approved cancer drug treatments

- SGD 600/year for specialist consultations and diagnostic services

Integrated Shield Plans (IPs)

- Enhances MediShield Life with access to private hospitals and specialists

- Covers non-CDL drugs through optional riders

- Increases claim limits and outpatient support

Critical Illness (CI) Insurance

- Provides a lump-sum payout upon diagnosis

- Helps fund treatment not covered by other plans and provides for living expenses, travel, or post-treatment care

Get Financial Support for Breast Cancer Treatment

Facing breast cancer can be emotionally and financially challenging. Even with strong medical support, the costs involved can add significant stress. That’s why it’s important to speak with a financial consultant who can help you understand your insurance coverage, whether it’s MediShield Life, MediSave, Integrated Shield Plans (IPs), or Critical Illness (CI) plans. A financial consultant can identify potential coverage gaps, recommend suitable riders, and guide you on how to maximise MediSave withdrawals and MediShield claims. With the right advice, you can build financial resilience throughout your treatment and recovery.

Click the button below to connect with one of our preferred financial consultants and take the next step toward peace of mind and financial clarity on your health journey.

Browse Cancer Marker Screening Packages

Disclaimer: 365Asia aims to provide accurate and up-to-date information, our contents do not constitute medical or any professional advice. If medical advice is required, please consult a licensed healthcare professional. Patient stories are for general reading. They are based on third-party information and have not been independently verified.